Uncategorized

now browsing by category

US Covid-19 Charts 5/6/20

Chart Summary

The following charts have been compiled to provide some insight into how the coronavirus (Covid-19) is spreading throughout the United States. The charts have been grouped into the following categories:

- Cases per State

- Deaths per State

- Rate of Increase of Covid-19 Cases by State – Week ending 05/03/20

- Rate of Increase of Covid-19 Deaths by State – Week ending 05/03/20

The first two chart categories show ten days of data and are arranged in four groups. The groups were set up in the descending order of cases per state (also including Puerto Rico and the District of Columbia) on April 18, 2020. The State of New York has been excluded from the Cases per state and Deaths per state charts due to the sheer magnitude of cases and deaths in that state. Excellent coverage of Covid-19 in New York is provided in The Gothamist.

These charts have been compiled using data from The Guardian and CNN who both cite their source of data as Johns Hopkins University & Medicine

Also See Politico and The COVID Tracking Project who provide detailed information of the number of people in each state that have been tested for the virus.

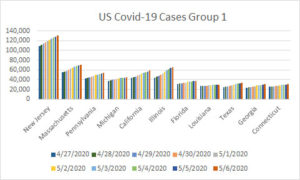

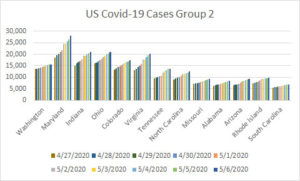

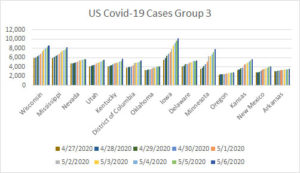

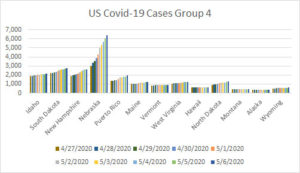

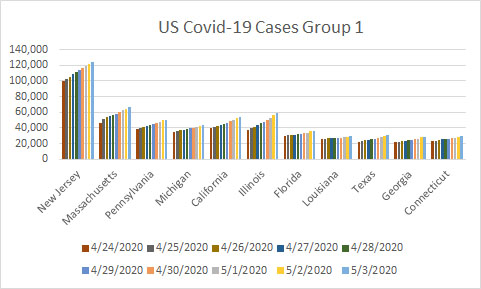

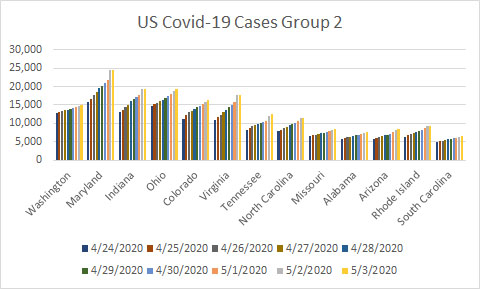

Covid-19 Cases per State

Covid-19 Cases in NJ, MA, PA, MI, CA, FL, LA, TX, GA and CT for the 10 day period ending 05/06/20

Covid-19 Cases in WA, MD, IN, OH, CO, VA, TN, NC, MO, AL, AZ, RI and SC for the 10 day period ending 05/06/20

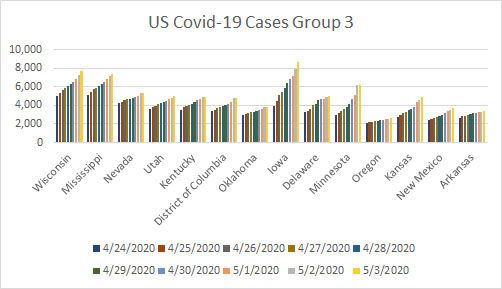

Covid 19 Cases in WI, MI, NV, UT, KY, DC, OK. IA, MN, OR, KS, NM and AR for the 10 day period ending 05-06-20

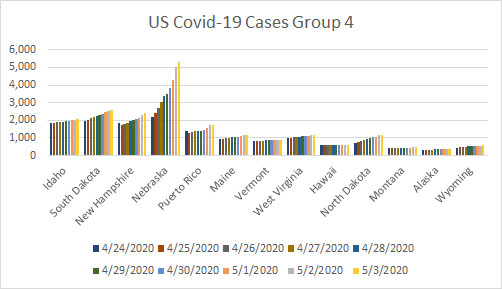

Covid-19 Cases in ID, SD, NH, NE, PR, ME, VT, WV, HI, SD, MT, AK and WY for the 10 day period ending 05-06-20

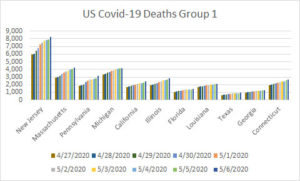

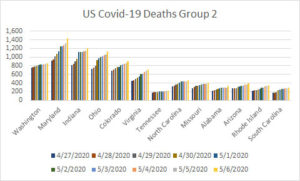

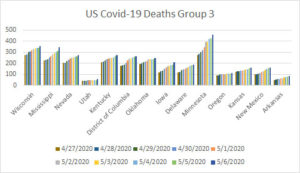

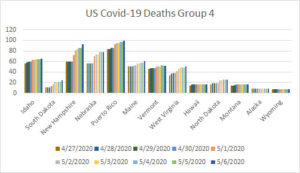

Covid-19 Deaths per State

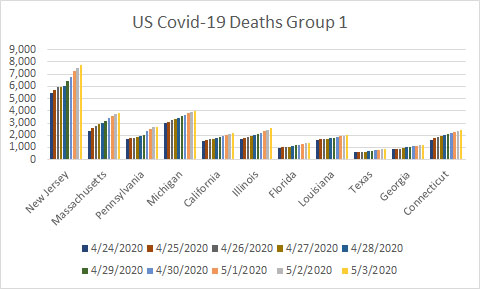

Covid-19 Deaths for NJ, MA, PA, MI, CA, FL, LA, TX, GA and CT for the 10 day period ending 05/06/20

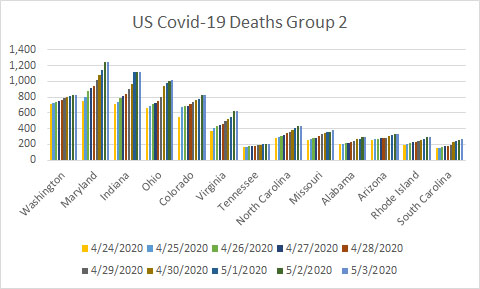

Covid-19 Deaths in WA, MD, IN, OH, CO, VA, TN, NC, MO, AL, AZ, RI and SC for the 10 day period ending 05/06/20

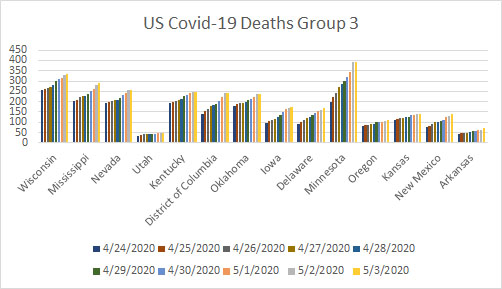

Covid 19 Deaths in WI, MI, NV, UT, KY, DC, OK. IA, MN, OR, KS, NM and AR for the 10 day period ending 05-06-20

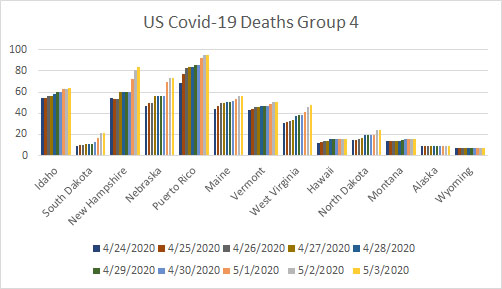

Covid-19 Deaths in ID, SD, NH, NE, PR, ME, VT, WV, HI, SD, MT, AK and WY for the 10 day period ending 05-06-20

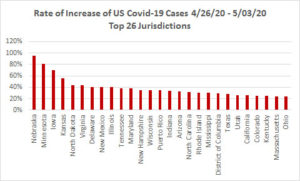

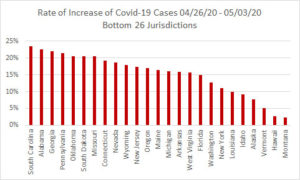

Rate of Increase of Covid-19 Cases

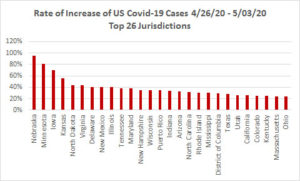

Jurisdictions with the highest rate of increase in Covid-19 cases for the week ending May 3, 2020

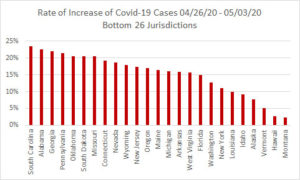

States with a lower rate of increase of Covid-19 cases for the week ending May 3, 2020

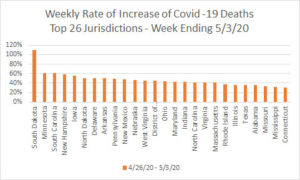

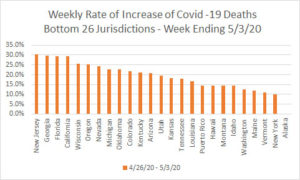

Rate of Increase of Covid-19 Deaths

Jurisdictions with the highest rate of increase in Covid-19 Deaths for the week ending May 3, 2020

States with a lower rate of increase of Covid-19 Deaths for the week ending May 3, 2020

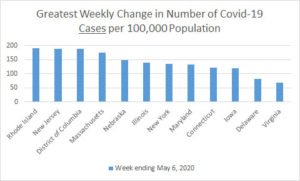

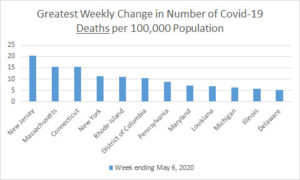

Top 12 Weekly Changes Per 100,000 Population

Top 12 States in change in number of cases per 100,00 Population in the week ending May 6, 2020

Top 12 States in Change of Number of Deaths per 100,000 Population for the week ending 5-6-2020

About the Author

Carl E. Peters is a licensed Professional Engineer, Land Surveyor, Planner and Construction Official. His firm, Carl E. Peters, LLC, is located in Fords, NJ.

US Covid-19 Charts 5/3/20

Chart Summary

The following charts have been compiled to provide some insight into how the coronavirus (Covid-19) is spreading throughout the United States. The charts have been grouped into the following categories:

- Cases per State

- Deaths per State

- Rate of Increase of Covid-19 Cases per State – Week ending 05/03/20

The first two chart categories show ten days of data and are arranged in four groups. The groups were set up in the descending order of cases per state (also including Puerto Rico and the District of Columbia) on April 18, 2020. The State of New York has been excluded from the Cases per state and Deaths per state charts due to the sheer magnitude of cases and deaths in that state. Excellent coverage of Covid-19 in New York is provided in The Gothamist.

These charts have been compiled using data from The Guardian and CNN who both cite their source of data as Johns Hopkins University & Medicine

Also See Politico and The COVID Tracking Project who provide detailed information of the number of people in each state that have been tested for the virus.

Covid-19 Cases per State

Covid-19 Deaths per State

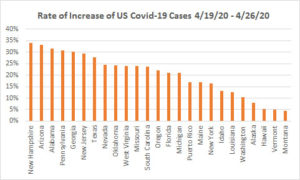

Rate of Increase of Covid-19 Cases

Jurisdictions with the highest rate of increase in Covid-19 cases for the week ending May 3, 2020

States with a lower rate of increase of Covid-19 cases for the week ending May 3, 2020

About the Author

Carl E. Peters is a licensed Professional Engineer, Land Surveyor, Planner and Construction Official. His firm, Carl E. Peters, LLC, is located in Fords, NJ

US Covid-19 Charts

Revised April 30, 2020

Chart Summary

The following charts have been compiled to provide some insight into how the coronavirus (Covid-19) is spreading throughout the United States. The charts have been grouped into the following categories:

- Cases per State

- Deaths per State

- Cases per 100,000 Population per State

- Deaths per 100,000 Population per State

- Rate of Increase of Covid-19 Cases per State

The first four chart categories show ten days of data and are arranged in four groups. The groups were set up in the descending order of cases per state (also including Puerto Rico and the District of Columbia) on April 18, 2020. The State of New York has been excluded from the Cases per state and Deaths per state charts due to the sheer magnitude of cases and deaths in that state. Excellent coverage of Covid-19 in New York is provided in The Gothamist.

These charts have been compiled using data from The Guardian and CNN who both cite their source of data as Johns Hopkins University & Medicine

Also See Politico and The COVID Tracking Project who provide detailed information of the number of people in each state that have been tested for the virus.

Covid-19 Cases per State

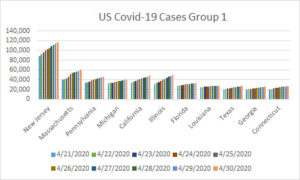

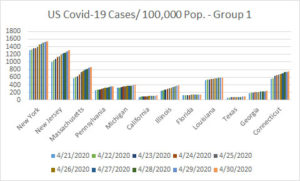

Covid-19 Cases in NJ, MA, PA, MI, CA, IL, FL, LA, TX, GA & CT from 4-21-2020 through 04-30-20

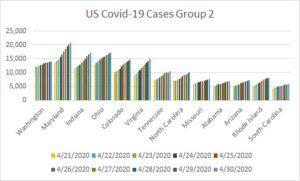

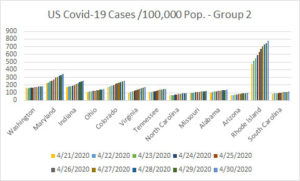

Covid-19 Cases in WA, MD, IN, OH, CO, VA, TN, NC, MO, AL, AZ, RI and SC from 04-21-2020 through 04-30-2020

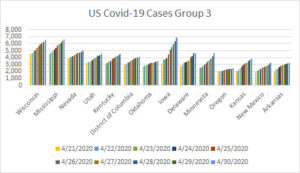

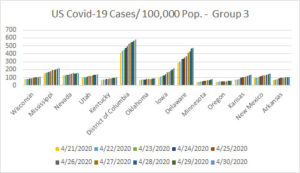

Covid-19 Cases in WI, MI, NV, UT, KY, DoC, OK, IA, DE, MN, OR, KS, NM and AR from 4-21-20 through 04-30-2020

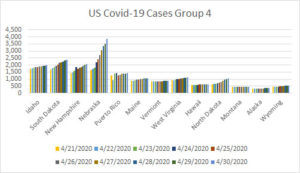

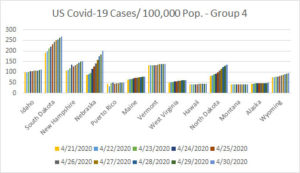

Covid-19 Cases in ID, SD, NH, NB, PR, ME, VT, WV, HI,, ND, MT, AK and WY from 04-21-2020 through 04-30-2020

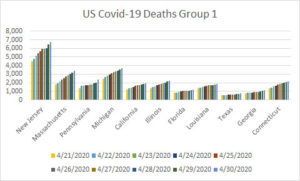

Covid-19 Deaths per State

Covid-19 Deaths in NJ, MA, PA, MI, CA, IL, FL, LA, TX, GA & CT from 4-21-2020 through 04-30-20

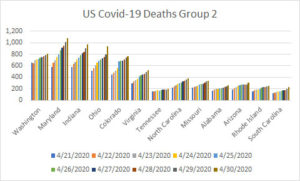

Covid-19 Deaths in WA, MD, IN, OH, CO, VA, TN, NC, MO, AL, AZ, RI and SC from 04-21-2020 through 04-30-2020

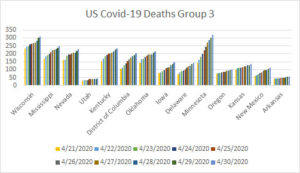

Covid-19 Deaths in WI, MI, NV, UT, KY, DoC, OK, IA, DE, MN, OR, KS, NM and AR from 4-21-20 through 04-30-2020

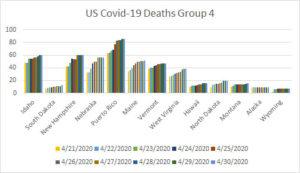

Covid-19 Deaths in ID, SD, NH, NB, PR, ME, VT, WV, HI,, ND, MT, AK and WY from 04-21-2020 through 04-30-2020

Covid-19 Cases per 100,000 Population by State

Covid-19 Cases per Capita in NJ, MA, PA, MI, CA, IL, FL, LA, TX, GA & CT from 4-21-2020 through 04-30-20

Covid-19 Cases per Capita in WA, MD, IN, OH, CO, VA, TN, NC, MO, AL, AZ, RI and SC from 04-21-2020 through 04-30-2020

Covid-19 Cases per Capita in WI, MI, NV, UT, KY, DoC, OK, IA, DE, MN, OR, KS, NM and AR from 4-21-20 through 04-30-2020

Covid-19 Cases per Capita in ID, SD, NH, NB, PR, ME, VT, WV, HI,, ND, MT, AK and WY from 04-21-2020 through 04-30-2020

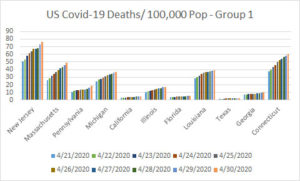

Covid-19 Deaths per 100,000 Population by State

Covid-19 Deaths per Capita in NJ, MA, PA, MI, CA, IL, FL, LA, TX, GA & CT from 4-21-2020 through 04-30-20

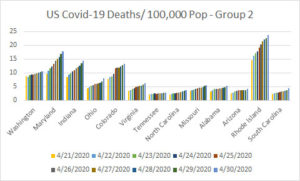

Covid-19 Deaths per Capita in WA, MD, IN, OH, CO, VA, TN, NC, MO, AL, AZ, RI and SC from 04-21-2020 through 04-30-2020

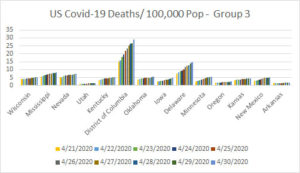

Covid-19 Deaths per Capita in WI, MI, NV, UT, KY, DoC, OK, IA, DE, MN, OR, KS, NM and AR from 4-21-20 through 04-30-2020

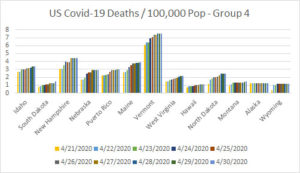

Covid-19 Deaths per Capita in ID, SD, NH, NB, PR, ME, VT, WV, HI,, ND, MT, AK and WY from 04-21-2020 through 04-30-2020

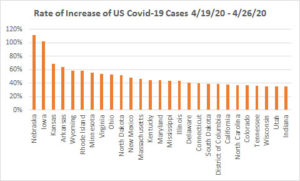

Rate of Increase of Covid-19 Cases

Weekly Rate of Increase of Covid-19 Cases – Top Group

Weekly Rate of Increase of Covid-19 Cases – Bottom Group

About the Author

Carl E. Peters is a licensed Professional Engineer, Land Surveyor, Planner and Construction Official. His firm, Carl E. Peters, LLC, is located in Fords, NJ

Is the ADA a Tenant or Landlord Responsibility?

ADA compliance – is the landlord or tenant responsible? Are there areas of shared responsibility?

The Americans with Disabilities Act (ADA) prohibits any private entity who owns, leases – or leases to, or operates a place of public accommodation from discriminating against a person with a disability. Both the landlord and tenant have the responsibility for compliance with the ADA. They may choose to allocate these responsibilities between them through a lease or other contract. This allocation is only effective between the parties – both landlord and tenant remain fully liable for complying with the requirements of the ADA.

Problems with Allocation of ADA Responsibility between Tenant and Landlord

Consider the example of a tenant operating a place of public accommodation as part of a larger place of public accommodation – such as a restaurant within a strip mall. The lease may describe the rented space as including the area within the four walls of the restaurant while defining the common areas as including the site improvements such as parking lots and sidewalks. In such an example, the lease may allocate responsibility to the tenant for the interior space only, while specifying that the common elements are the responsibility of the landlord. While this allocation of responsibility may seem fairly clear, site specific facts may make matters more complicated.

Operations of Tenant

In this example, the tenant might argue that it had no responsibility for barriers to the exterior path of travel. However, what if the tenant regularly placed merchandise or an advertising feature on the sidewalk blocking the exterior accessible path of travel? Is that a tenant problem or a landlord problem? The lines of responsibility get blurry. On one hand, the tenant took an action that could block access to goods and services. On the other hand, the landlord had a responsibility for the entire property.

Alterations by Tenant

When alterations or renovations are made to the tenant space, the altered space must be constructed in accordance with the Americans With Disabilities Accessibility Guidelines (ADAAG). In many jurisdictions, such alterations require obtaining of a construction permit and passing inspections performed by local officials.

The scope of such alteration projects must also include removal of barriers in the accessible route from the building entrance to the altered space. The cost of these accessibility improvements is not required to exceed 20% of the cost of the basic alteration. If the accessible path of travel is already ADA compliant, no additional improvements will be required.

Sometimes, the accessible route within the tenant space complies with the regulations but barriers exist on the exterior route of travel. Alterations to the tenant space do not necessarily trigger path of travel improvements outside of tenant space. Removal of these barriers within the common areas of a place of public accommodation is likely to remain with the landlord.

Who gets sued for violations of the ADA?

In my experience, both the landlord and tenant may be sued by a disabled individual who has been deprived of access to a place of public accommodation. It it prudent for landlords, property managers and tenants to work together to identify barriers to access and create a plan for their removal.

The information provided in this article is based upon my review of the Americans with Disabilities Act, The 2010 Accessibility Guidelines, the Americans with Disabilities Act Title III Regulations. And the Title III Technical Assistance Manual. It describes what I have found to be the most common issues encountered during my ADA investigations. For a more complete review of the Americans with Disabilities Act (ADA) please refer to the law, regulations and standards referenced, herein.

Return to Frequently Asked Questions

ADA Site Design Element Examples

What Site Design Elements are impacted by the requirements of the Americans with Disabilities Act (ADA)?

The 2010 ADA Standards for Accessible Design create minimum standards for a wide array of building and site features.

When I begin a site investigation, I think about the ways that a person might arrive at the site. Did they arrive by car, mass transportation or did they walk or travel by a mobility device? Here are some examples of some of things to check for:

Arrival by car or van:

- Are there an adequate number of accessible parking spaces?

- Are the accessible spaces close to the building entrance?

- Are the spaces fairly level in both directions?

- Are the spaces adjacent to a proper access aisle?

- Are the spaces properly identified by signs and pavement markings?

- Do the access aisles connect with an accessible route to the building entrance? (See considerations for approach from an adjacent property or transportation stop).

Approach the site from an adjacent property or bus stop:

- Are there proper curb ramps to get to the sidewalk from the pavement?

- Are the walkways wide enough?

- Are the walkways sloped properly?

- In the direction of travel

- Is the path too steep to meet the definition of a walk? Is it a ramp?

- Perpendicular to the direction of travel

- In the direction of travel

- Are there excessive changes in level?

- Steps

- Heaved, cracked or settled slabs

- Lips at ramps and/or doorways

- Are all required curb ramps constructed properly?

- Proper ramp width

- Proper ramp slope

- Proper side slope

- Proper landing

- Size

- Slope

- Detectable warning surface, if required

Some Problems I’ve found with Site Design Elements:

Parking Spaces:

No Access Aisle:

There is no access aisle for this accessible parking space

Excessive Cross Slope:

An Example of Excessive Cross Slope in an Accessible Parking Space

Ramps Protruding into Access Aisle:

This ramp protrudes into the access aisle for the accessible parking space

Curb Ramps:

Steep side slopes:

This curb ramp has side slopes which are too steep

Lip at base of Ramp:

Sidewalks:

Excessive cross slope and change of level:

This section of sidewalk has both an excessive cross slope and abrupt change of level

The examples provided above are just a portion of the site elements for which ADA standards have been developed. I recommend the following resource provided by the New England ADA Center – ADA Checklist for Existing Facilities as an aid for inspecting your facility to determine if you comply with the requirements of the ADA.

The information provided in this article is based upon my review of the Americans with Disabilities Act, The 2010 Accessibility Guidelines, the Americans with Disabilities Act Title III Regulations. And the Title III Technical Assistance Manual. It describes what I have found to be the most common issues encountered during my ADA investigations. For a more complete review of the Americans with Disabilities Act (ADA) please refer to the law, regulations and standards referenced, herein.

Return to Frequently Asked Questions

Readily Achievable ADA Modifications

What Types of Building and Site Modifications are considered to be readily achievable by the ADA?

The Americans with Disabilities Act (ADA) requires Places of Public Accommodation to remove architectural barriers when it is readily achievable to do so. Readily achievable means easily accomplished and able to be carried out without much difficulty or expense.

To determine what is readily achievable, one must consider factors such as:

- The nature and cost of the action;

- The overall financial resources of the site involved;

- Safety concerns;

- Impact upon the operation of the site;

- The relationship of the site to a parent corporation.

Examples of Readily Achievable Repairs

Examples of readily achievable steps to remove barriers include, but are not limited to, the following actions:

- Installing ramps;

- Installing curb cuts;

- Eliminating excessive slope or cross-slope on sidewalks;

- Eliminating excessive changes in level along accessible routes;

- Removing obstacles in accessible routes;

- Rearranging tables, chairs, display racks, and other furniture;

- Widening doors or installing offset hinges;

- Installing accessible door hardware;

- Installing grab bars in toilet stalls;

- Installing accessible faucets;

- Rearranging toilet partitions to increase maneuvering space;

- Insulating pipes under sinks to prevent burns;

- Installing a full-length bathroom mirror;

- Re-positioning bathroom accessories such as toilet paper and paper towel dispensers;

- Creating designated accessible parking spaces;

- Installing proper ADA signage.

The information provided in this article is based upon my review of the Americans with Disabilities Act, The 2010 Accessibility Guidelines, the Americans with Disabilities Act Title III Regulations. And the Title III Technical Assistance Manual. It describes what I have found to be the most common issues encountered during my ADA investigations. For a more complete review of the Americans with Disabilities Act (ADA) please refer to the law, regulations and standards referenced, herein.

Return to Frequently Asked Questions

Keeping up with Changes to the ADA – “Safe Harbor”

“How do I keep up with constant code changes to the ADA?”

I’ve heard building owners and property managers lament “How do we keep up with accessibility code changes?” The Safe Harbor provisions of the Americans with Disabilities Act (ADA) provide relief for facility owners that complied with the 1991 Standards for Accessible Design (1991 Standards).

What are the Safe Harbor Provisions of the ADA?

The ADA contains a provision – the Safe Harbor Provision – which exempts building and site elements which were installed in accordance with the 1991 Standards from complying with the more rigorous requirements of the 2010 Standards for Accessible Design (2010 Standards). This exception is in force unless the facility was altered after the initial construction was completed. Such facilities are not required to comply with the 2010 Standards until such time as alterations to the premises are planned.

Elements that are ineligible for Safe Harbor

There are some elements that are not eligible for protection under the Safe Harbor rule. Safe Harbor does not apply to elements in existing facilities for which there are neither technical nor scoping specifications in the 1991 Standards. These elements must be modified to the extent readily achievable to comply with the 2010 Standards. Some elements not eligible for safe harbor are:

- Residential facilities and dwelling units;

- Amusement rides;

- Recreational boating facilities;

- Exercise machines and equipment;

- Fishing piers and platforms;

- Golf and Miniature Golf facilities;

- Play areas;

- Saunas and steam rooms;

- Swimming pools, wading pools, and spas.

The information provided in this article is based upon my review of the Americans with Disabilities Act, The 2010 Accessibility Guidelines, the Americans with Disabilities Act Title III Regulations. And the Title III Technical Assistance Manual. It describes what I have found to be the most common issues encountered during my ADA investigations. For a more complete review of the Americans with Disabilities Act (ADA) please refer to the law, regulations and standards referenced, herein.

Return to Frequently Asked Questions

Who Gets ADA Exemptions?

Are There Exemptions from The Americans With Disabilities Act (ADA)?

Not many places of public accommodation get ADA exemptions. Places of Worship and some Private Clubs (establishments exempted from coverage under title II of the Civil Rights Act of 1964 (42 U.S.C. 2000-a(e))) are generally exempt from the provisions of the ADA – but that exemption is not absolute.

ADA exemptions for premises owned by places of worship or private clubs may be lost if the facilities are leased to operators of a place of public accommodation.

Also, determining what type of entity is considered to be a private club is somewhat elusive as the term was not defined in the Civil Rights Act of 1964.

What Qualifies as a Private Club?

The Pepperdine Law Review in its article “The Private Club Exemption from Civil Rights Legislation – Sanctioned Discrimination or Justified Protection of Right to Associate” identifies some criteria that the courts have used to qualify organizations as private clubs, including:

- The extent that the facilities of such establishment are made available to the customers or patrons of an establishment;

- Numerical limit on membership;

- Use of facilities by non-members;

- Club advertisement;

- Profit or non-profit status;

- Public funding.

While the facilities of religious organizations and private clubs may be exempt from the retrofit provisions of the ADA, they risk excluding valuable members from participation in their organizations.

New Construction and Alterations

The 2015 International Building Code (IBC) has been adopted in New Jersey and many other jurisdictions to regulate the construction of new buildings. The accessibility provisions, which are found in Chapter 11 of the IBC, do not provide global ADA exceptions for religious organizations or private clubs. Alterations to existing buildings are required to include modifications that improve accessibility that do not disproportionately increase the cost of the alteration work.

The information provided in this article is based upon my review of the Americans with Disabilities Act, The 2010 Accessibility Guidelines, the Americans with Disabilities Act Title III Regulations. And the Title III Technical Assistance Manual. It describes what I have found to be the most common issues encountered during my ADA investigations. For a more complete review of the Americans with Disabilities Act (ADA) please refer to the law, regulations and standards referenced, herein.

Return to Frequently Asked Questions

Mandated ADA Repair Schedule

When Are Places of Accommodation Required to Comply with The Americans With Disabilities Act (ADA)?

ADA repair schedule for facilities that existed in 1990

- All existing Places of Public Accommodation were required to comply with the requirements of the 1991 Standards to the extent readily achievable by July 26, 1993.

Facilities built after March 15, 2012 and existing facilities that didn’t make repairs

- Compliance with the 2010 Standards became effective for new construction and alterations on March 15, 2012. Places of public accommodation that were constructed or renovated after the passage of the ADA should have complied with the 1991 Standards. If they have not done so by March 15, 2012, they must comply with the 2010 Standards.

Pool and Spa Requirements

- Existing pools, wading pools, and spas built before March 15, 2012, having elements that do not comply with the supplemental requirements for entry to pools, wading pools, and spas must be modified to the extent readily achievable

Facilities that have complied with the 1991 Standards

- Existing building and site elements that comply with the requirements for the 1991 Standards and were not altered after March 15, 2012 do not need to be modified.

The information provided in this article is based upon my review of the Americans with Disabilities Act, The 2010 Accessibility Guidelines, the Americans with Disabilities Act Title III Regulations. And the Title III Technical Assistance Manual. It describes what I have found to be the most common issues encountered during my ADA investigations. For a more complete review of the Americans with Disabilities Act (ADA) please refer to the law, regulations and standards referenced, herein.

Return to Frequently Asked Questions

Who Needs to Comply with the ADA?

Which Businesses Need to Comply with the ADA? What is a Place of Public Accommodation?

When do Architectural Barriers need to be removed?

I’m often asked questions about the Americans With Disabilities Act (ADA), such as, “If I haven’t done any construction on my property, do I still need to make modifications for handicapped access?” The answer is “It depends.” It depends upon the answers to the following questions:

- Is it privately owned or operated?

- Is it an existing facility?

- Is it a commercial use?

- Is it a “Place of Public Accommodation?”

If the facility is publicly owned or operated by a state or local government, you must comply with the Title II standards of the ADA. Most public facilities are required to be retrofitted for compliance with the 2010 Standards.

What Is A Place of Public Accommodation?

If the property is privately owned or operated, the answer lies in whether the facility is considered a commercial use or a place of public accommodation. The ADA prohibits discrimination against disabled individuals by any person who owns, leases or operates a place of public accommodation.

The ADA contains twelve categories of premises that are considered Places of Public Accommodation – meaning a facility operated by a private entity whose operations affect commerce, examples include:

- Hotels and motels;

- Restaurants, bars, or other establishments serving food or drink;

- Theaters and stadiums;

- Auditoriums, convention centers, and other place of public gathering;

- Shopping centers, retail stores or other sales or rental establishments;

- Service Businesses such as laundromats, banks, beauty;

- Offices, health care providers, hospitals;

- Terminals or stations used for specified public transportation;

- Museums or libraries;

- Parks and places of recreation;

- Private schools, or other places of education;

- Day care center, or other social service establishment; and

- Gyms, Bowling alleys and golf courses.

Discrimination includes failure to remove architectural barriers, and communication barriers that are structural in nature, in existing facilities. The law does, however, provide that when the removal of a barrier is not readily achievable, alternative methods of providing the goods or services may be possible.

Facilities include buildings, structures, sites, equipment, walkways and parking lots.

What About Other Commercial Properties?

Commercial buildings, which do not meet the definition of a place of public accommodation, are obligated by the ADA to meet accessibility standards when newly constructed or altered. Such improvements are often also regulated by local codes and ordinances and may require the facility owner or operator to obtain permits and have the improvements inspected. Places of public accommodation which are newly constructed or altered have similar requirements.

While enforcement of accessibility standards for new construction and alterations is often provided by local government through their Building and/or Engineering Departments, removal of barriers in existing places of accommodation is more likely to be enforced through lawsuits.

Owners and operators of places of public accommodation who fail to identify and remove architectural barriers can find themselves as defendants in such lawsuits.

D5 Creation

D5 Creation